In June, the people of Great Britain chose to leave the European Union. What will this mean for Switzerland and its economy? The effects are already being felt at several levels.

1. Interests rates will remain low for even longer

Brexit will go down in history as the mildest stock market crash ever. Although there was great anxiety in New York, London and Tokyo on the morning of 24 June, the panic had evaporated again within days. Indeed the losses had been recouped by the first week of July, including at the Zurich stock exchange. One reason for this is that investors realised that the result of the referendum would have almost no immediate consequences. After all, the negotiations between Great Britain and the EU are likely to drag on for two or more years. It is still not clear what future economic relations between the two will look like. The United Kingdom may even maintain relatively close ties with the Continent through the European Economic Area.

However, there’s also another reason for the stock market rally: interest rates have fallen again. Major central banks like the Federal Reserve and the European Central Bank look likely to continue pursuing very expansive monetary policies. That will drive share prices upwards. Borrowing must remain cheap because the economy is still sluggish, especially in Great Britain, where the Bank of England cut its base rate to an all-time low in the aftermath of the Brexit vote in expectation of a significant economic slump.

These negative economic developments are affecting Switzerland, where returns on ten-year federal loans are now at -0.5 %, their lowest point ever. As a result, the hoped-for normalisation of global interest rates has moved further into the distance. This also means that the Swiss National Bank (SNB) will have to maintain for even longer its negative interest rates that are designed to put international investors and those with significant savings off the Swiss franc. This will particularly hurt the likes of pension funds and health insurers, which hold large amounts of liquid assets.

2. Pressure on the Swiss franc will remain high

The SNB weathered the initial post-Brexit storm well. Although the exchange rate against the euro fell from CHF 1.10 to CHF 1.06 in the immediate aftermath of the vote, it was soon back between CHF 1.08 and CHF 1.09. That was largely thanks to clear communication by the SNB and its intervention on the foreign exchange market. In the decisive phase around the Brexit referendum, the SNB spent CHF 11 billion buying up foreign currencies. However, it can’t relax just yet. The foreign exchange market may explode again and the pressure on the Swiss franc looks unlikely to diminish. Observers reckon that the SNB is continuing to buy up foreign currencies to maintain a first line of defence at CHF 1.08. If tensions in Europe rise further, the SNB would have no choice but to cut interest rates again to stabilise the euro exchange rate at about CHF 1.05.

3. Damage to exports and tourism

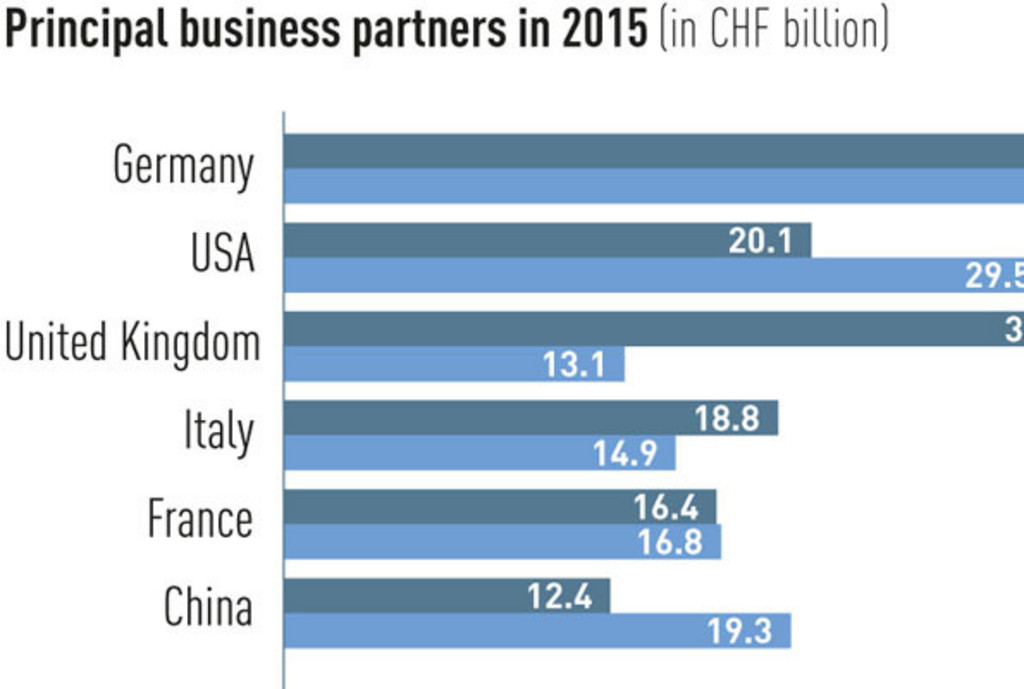

Six percent of Switzerland’s exports go to Great Britain. The eurozone accounts for 40 %. The slight upswing in these markets proved an important boost for the Swiss economy following the shock to the franc. Were investment as well as consumer spending in these regions to fall, this would also hit Swiss companies. With the exception of the crisis-resistant pharmaceutical industry, most export sectors are likely to feel the knock-on effect of Brexit. That’s bad news for the tourist industry in particular, which is already in the doldrums, with fewer hotel bookings in the first half of the year. In a typical year, some 700,000 Brits visit Switzerland. The weaker pound means many of these will now stay at home. If they do travel to Lucerne, Mürren or Verbier, they will have less money for restaurants and souvenirs. Nonetheless, Theresa May spent her holidays in Zermatt in August. Her stay was a godsend: posing in hiking pants and a polo shirt with trekking poles and a backdrop of Swiss mountains, Great Britain’s new prime minister told a mass of British journalists how wonderful it was to wander in the Alps.

The banks will have to get by without such advertising. Financial institutions like Credit Suisse have lost out on the stock exchange. The price of shares in Switzerland’s second-biggest bank even briefly fell to below CHF 10. But Swiss banks aren’t alone in their sorrows. Low interest rates are depressing revenues throughout Europe. As such, banks from Italy to Germany are suffering under low profitability and an uncertain future.

4. Agreement with Europe moving into the background

Brexit probably killed off any hopes for a rapid and strict implementation of the mass immigration initiative as intended by those behind it. It is widely believed the EU will now take great care not to make any concessions on migration whilst the negotiations with Great Britain are underway. On the other hand, this realisation has led Swiss politicians to speed up their search for a solution without the SVP. A compromise currently taking shape would involve implementation of the initiative with a slight domestic bias. Under this proposal, put forward by the FDP, employers would be obliged to report job vacancies to regional job centres in Switzerland before recruiting applicants from abroad. On the other hand, a regional and sector-specific protection clause suggested by the CVP would also apply. Experts are not ruling out the possibility that such a package, which would require neither ceilings nor quotas and would therefore be compatible with EU principles, could be approved by 7 February 2017.

To what extent such a solution would restrict immigration remains to be seen. Nevertheless, it would be good for Swiss companies, which rely on stable underlying conditions and flexible migration policies.

5. A chain reaction: the political worst-case scenario

The Brexit vote has given nationalists yet another boost. Far-right politicians like Marine Le Pen are now demanding their own referendum on the EU and the euro. Their claim that European integration harms their countries more than it benefits them is backed up by economic developments. After all, figures released for the last few quarters show the eurozone economy in sluggish mood. Only Germany has grown. The French and Italian economies are stagnating.

The next test for the European project will come in November, when Italians vote on a constitutional amendment that Prime Minister Matteo Renzi has staked his political future on. France goes to the polls to elect a new president in 2017. Should eurosceptic movements like the Front National or Movimento 5 Stelle come to power, Europe’s disintegration could gather pace. Already, a mere 49 % of Italians consider the European common currency to be beneficial.

It’s hard to predict what impact such a scenario would have on the financial markets. The Swiss franc would undoubtably skyrocket in value. Were a country like Italy to leave the eurozone, an increase in unemployment and a recession would be the least that Switzerland could expect.

Simon Schmid is chief economist at the “Handelszeitung”

![[Translate to en:]](/fileadmin/_processed_/9/e/csm_maggi-flasche-geneigt_d99b6f4bac.jpg)

Comments

Comments :

Informasi perlu

Jenengmu...

jeneng pungkasan ...

SEX ..

IT WIS ...

Wong tuwo......

ID kertu bener ...

Tujuan saka silihan ........

Income wulan YOUR ....

Loan Jumlah Needed ....

Duration saka Loan ing ....

Valid nomer ponsel ....

Matur nuwun lan Gusti Allah mberkahi.

I offer online services offering a secured and secured loan at a very low interest rate of% 3 I offer personal loans, debt consolidation loan, venture capital, commercial loan, loan for Education, a home loan or a loan for any reason whatsoever. Do you have bad credit? You can always apply.

Note: For the personal loan amount, you must have a minimum of $ 5,000 and a maximum of $ 150,000, while the amount of business and investment loans is less than $ 100,000 and a maximum of $ 50,000 000$.

Contact us today for your applications! (Kowalskaanna12@yahoo.com)

Yours truly,

Do you need an urgent financial credit ***? * Very fast and direct transfer to your bank account * Repayment starts eight months after you get the money bank account * Low interest rate of 1% * Long-term repayment (1-30 years) Height * Flexible ***then monthly payment *. How long will it be financed? After submitting the application *** You can expect a preliminary answer less than 24 hours funding in 72-96 hours after receiving the information they need yours.

Contact this legitimate and licensed company authorized give financial assistance to anyone For more information and the application form ***

OUR COMPANY CONTACTS :

Company Email : (anatiliatextileltd@gmail.com)

Company Email : (Emaill: bdsfn.com@gmail.com)

I will relish the opportunity of doing business with you and also help to put your financial problems behind you by offering you a loan. You are in the right place. If serious and want to take a loan from our company, if you are interested fill the borrower"s information below so that we may commence the processing of your loan.

BORROWERS INFORMATION,if you are interested fill the borrower"s information below so that will can proceed.

LOAN INFORMATION NEEDED:

Name :

Country :

Phone number :

Amount Needed as Loan :

Purpose of Loan :

Loan Duration :

Monthly Income :

Have you applied for loan online before (yes or no)

OUR COMPANY CONTACTS :

Company Email : (anatiliatextileltd@gmail.com)

Company Email : (Emaill: bdsfn.com@gmail.com)

Company Motto : Your Happiness is our Award for Good Service (getting your financial stand is all we desire)

Thanks and do hope to hear from you soonest so that we may send you the loan Terms,Conditions and Repayment Schedule

Your swift response to this mail will be greatly appreciated.

All email must be sent to (Emaill: bdsfn.com@gmail.com)

Best Regards

Mrs. Magaret Becklas

silihan karo mbayar maneh gampang, kapentingan kita 2% ing Clear karya langgeng,

preduli saka lokasi utawa kredit kanggo njaluk Email silihan: missmaria005@gmail.com

pelamar kasengsem nyilih isi formulir ing ngisor iki

Utang INFORMASI *

* Jeneng lengkap: ...................... *

* SEX * .............................

* Umur ............................. *

* Title * ..................

* Contact: ................ *

* Negara ......................... *

* Telephone: * ..........................

* Jumlah dibutuhake minangka silihan: .......... *

* Duration Loan: .................. *

* Income Annual: .................. *

* Pagawéyan ..................... *

* Warranty: ..................... *

* Pembayaran: saben wulan utawa tahunan

THANK YOU AND Albar YOU

Coba

José María.

Kowe kudu silihan Lowongan?

Kudu silihan bisnis?

Kudu silihan kanggo investasi?

Kudu silihan kanggo finance masalah?

Kudu silihan pribadi?

Kudu silihan bisnis lan industri silihan?

Kanggo mlaku introduce myself, aku Pak Michael Howard tukang kredit pribadi

nyedhiyani silihan ing kapentingan tarif saka 2%. Iki financial

kesempatan ing langkah lawang dina lan njaluk loan.There cepet akeh

metu ana looking for opsi financial utawa bantuan sak panggonan lan

isih ora bisa njaluk siji. Nanging iku kesempatan financial ing lawang

langkah lan kanthi mangkono sampeyan ora bisa kantun kesempatan iki. Layanan kanggo

individu, perusahaan, pengusaha lan women.The kasedhiya silihan

jumlah kisaran saka $ 1,000.00 kanggo $ 500,000,000.00, utawa nomer

Sampéyan kanggo informasi luwih lengkap hubungi kita ing:

michaelhoward732@gmail.com

Alexa First needed

Jeneng lan surname:

Phone pribadi:

Negara: Alamat:

Negara:

Age:

jinis:

Wis Applied sadurunge? :

status perkawinan:

Jumlah silihan needed silihan:

Loan Duration:

Loan Tugas:

Work:

Income Monthly:

Hubungi kita ing: michaelhoward732@gmail.com

Kaya nunggu respon cepet,

anget Regards

Pak Michael Howard

Ganz einfach, die "Schweizer Revue" ist nicht neutral, sondern ein Instrument der Manipulation und Desinformation für den Bundesrat und gewisser pro EU-Polit-Eliten.

Meine sehr geehrten Damen und Herren

Bitte erlauben Sie mir, festzustellen, dass wir in einer globalisierten, digital vernetzten Welt leben. Da gelten belastbare Zahlen, Fakten und Daten.

Die da sind

Die Bevölkerung der Schweiz entspricht knapp 1,5% derjenigen Eu-

ropas, dahin liefern wir über 40% unserer Exporte. Der Exportanteil Europas an die Schweiz liegt bei ça 2,2%

Und nun erklären Sie mir bitte mit was für einem Demokratiever-

verständnis Sie mit dem Ausdruck "Diktatur von Brüssel" operieren.

Ich habe schon in der Primarschule rechnen, und später gelernt, dass die Mehrheit nun einmal sagt, was zu gehen hat, und was nicht.

Ach übrigens, nur so nebenbei noch,

Dass unsere Geburtenrate weit unter der Reproduktionsquote liegt

und wir somit ein EINWANDERUNGSLAND sind hindert uns doch nicht daran, unseren besten Kunden mit Zuwanderungsquatsch zu belästi-

gen. Mit dem Risiko, auch da ein Entscheid einer Mehrheit, die Schweiz aus dem Binnenmarkt zu kippen.

Aber eben, denken macht müde und Kopfweh.

Wie ist es doch so erhaben, bei passender und unpassender Gelegenheit die, ach so böse EU zu verschreien.

Ohne sich bewusst zu sein, dass unsere Exporte zu über 40% in diese Zonen gehen.

Fakt ist doch, kommende Historiker werden analysieren können, ob die EU gut oder schlecht ist.

Bis dahin gilt, beten wir doch, zu wem auch immer, dass es der

garstigen EU möglichst lange gut geht. Denn damit ist auch unser Wohlergehen gessichert.

Wonn denn bitte sind wir besser????????

Wir sind nicht un der Lage ein, von Experten geschaffenes stan-

dardisiertes Bildungssystem zu installieren, ohne dass das zum Politikum wird.

Unsere AHV, ein Vehikel aus dem Jahr 1948 an dem die letzten 20 Jahre nichts, aber auch gar nichts geändert wurde. Das heisst, wir werden etwas ganz anderes aufbauen müssen. Denn die im Jahr

2016 haben wir ganz andere Voraussetzungen als 1948.

Ich glaube nicht, das wir es(mit unserer "direkten Demokratie) schaffen etwas auf die Beine zu stellen, das verhindert, dass unsere Kinder in die Altersarmut abgleiten.

Wir haben eine sehr gute und effiziente Verwaltung. Die man mit

einem schlankeren Staat um mindesten 50% verringern könnte. Schon mal etwas von Hochlohnland gehört????

Daurch ist unsere Tourismussparte, einst eine Stütze unseres Volkseinkommens seit Jahren mit mit Negativwachstum.

Die Uhrenindustrie muss, wenn diese nicht kurzfristig etwas bahnbrechend Neues bringt, in Billiglohnländer ausweichen. Wo-

her soll denn das Geld für Forschung und Entwicklung kommen bei

einem Negativwachstum von9%????

Meine sehr geehrten Damen und Herren, galt doch vor noch nicht langer Zeit die Regel. Zuerst muss es vor der eigenen Haustüre

sauber sein. DANN, UND NUR DANN, KANN MAN KRITISIEREN, UND WENN

DOCH BITTE SACHLICH.

Haben Sie, meine sehr geehrten Damen und Herren, meinen besten Dank für Ihre gefl. Kenntnisnahme

Es ist interessant, wie primär nur rechtsgerichtete Briefe-schreiber in deutscher Sprache reagieren. Im Stile der SVP, d. h. mit Anschuldigungen und Behauptungen, die sie nicht belegen können. Stichworte wie Moloch, linke Aktivisten, Plünderung zeigen dies deutlich. Mehr Sachlichkeit und Diskussion wäre angebracht. Und nicht nur unhaltbare Behauptungen. Zu einer Diskussion gehört auch das Zuhören, was ich in diesen Reaktionen leider vermisse. Und von Kompromissen ist immer weniger zu spüren ...

Mit etwas gutem Willen auch der rechten und nationalistischen Kreise könnten wir gemeinsam auf eine wieder zuversichtlichere Euro-Zone zugehen.

Richard Walther, Frankreich

So richtig Sie auch mit Ihrer Einschätzung liegen, bitte verstehen Sie doch folgendes.

Die SVP WILL UND KANN doch nicht, auf Grund von sachlich und korrekten Basisinformationen diskutieren. Wo kämen wir da hin????

Da gilt doch nur Rechtspopulismus auf Teufel komm raus. Wenn da

keine sachlichen Argumente vorliegen, bedient man sich doch mit

dem was man hat. Eben rechtspopulistische Rohrkrepierer, damit

kann man in der Schweiz 30% Stimmenanteil holen.

Quo vadis confoederatio helveticae??

The Brits simply said enough. We will go it alone, work for our own future and will no longer submit to the politics of idiotic those Globalist control fantasies. They are the real terrorist.

partie de l'union Européenne,pas la Suisse,mais c'est la Suisse qui se plaint des conséquences.

Insuportable,a la fin.Ne suis pas souvent fière d'être Suisse,quand je lis ces pages,et quand je

M'informe de la politique Suisse.Contente d'habiter à l'étranger et 100 pro Européenne .

M.Buda

La sortie de la Grande Bretagne est peut-être "légèrement" défavorable pour la finance, mais peut représenter une réelle chance pour les autres aspects de l'Europe, vu que pour tout ce qui n'était pas finance, les Britanniques n'avaient qu'un mot à la bouche qui ressemble au "niet" soviétique.

Ce qui n'est pas dit, c'est combien le citoyen suisse paie ce luxe. J'ai vu que la BNS sort des milliards et des milliards pour que notre pays reste concurrentiel.

Mais finalement, si l'ensemble des citoyens payent, quelles sont ceux qui en retirent, cela ne doit pas être les mêmes dans les mêmes proportions.

De cette politique, on peut remarquer qu'on a crié très fort quand on a abandonné brusquement ( il faut bien que certains avisés fassent de gros bénéfices ) la politique d'achat de l'Euro qui l'a fait chuter à pratiquement la parité. Mais je n'ai pas vu beaucoup de journaux qui ont écrit que très rapidement la parité a changé et est revenue de 20% à 10%.

C'est comme les banques qui pleurent sans arrêt sur leurs difficultés et paradoxalement on voit de plus en plus de bâtiments bancaires partout. (idem pour les assurances qui nous volent notre pain)

Il en est de même pour les grosses entreprises qui viennent s'installer gratuitement sur certaines communes et qui posent leurs bénéfices soit dans des communes fiscalement avantageuses ou même dans les îles Caïman ou Bermudes et ne demandant pas à ces dits paradis fiscaux de participer à l'infrastructure du lieu de production.

Il en est de même de l'insouciance des négociateurs avec l’Extrême-Orient qui permet d'acheter aux prix locaux et de revendre au prix suisse. Dans le fond, cela semble correct, mais à réfléchir, cela ne va pas non plus.

que se passe-t-il dans un ménage quand on achète plus qu'on produit? Il faut passer par des combines etc.

Die CH würde gut daran tun, sich von der EU nicht alles gefallen zu lassen und sich vermehrt Grossbritannien anzunähern.

Jean Duvide

Peter Lang the question marks are a mistake

Ein EWR und/oder europäischer Binnenmarkt hat jahrelang gute Dienste geleistet. Wir kommen sehr gut oder sogar besser ohne EU und Euro aus. Von einigen Erschuetterungen bei der Abschaffung abgesehen handelt es sich bei meiner vorgeschlagenen Lösung um die längerfristig bessere.

Emma Marxer-Tobler