The National Council and Council of States have been wrangling for two and a half years over the reform of old-age and survivors’ insurance (AHV) and occupational pension (BVG). They have been entrenched in their positions over key points for so long that a conference of conciliation between the two chambers was called last March.

The dispute centres on the seemingly insignificant issue of whether or not future pensioners should receive 70 Swiss francs more a month in AHV benefits. The comprehensive reform of AHV and the second pillar was finally passed by Parliament in March by the narrowest of majorities. In the National Council vote, the centre-left camp – made up of the Swiss Social Democratic Party (SP), the Greens, the Swiss Christian Democratic People’s Party (CVP) and the Swiss Conservative Democratic Party (BDP) – managed to secure the exact majority required of 101 votes for the pension increase. The support of the two Lega MPs and the seven Green Liberals ultimately got them over the line. The latter reluctantly approved the reform despite disagreeing with the pension increase. The Lega MPs, who are part of the Swiss People’s Party (SVP) parliamentary group, took the liberty of invoking their movement’s social policy programme which calls for an enhancement of AHV.

Social Affairs Minister Alain Berset (SP) now has the opportunity to go down in history as the Federal Councillor to bring about the first AHV reform since the 1990s while at the same time putting the second pillar on a more solid footing by lowering the conversion rate which determines the level of pension. In 2010, 72 % of the electorate rejected a conversion rate reduction. Berset has therefore pinned his hopes on a comprehensive and simultaneous reform of both pillars having a better chance of gaining the support of the Swiss people. The SP Federal Councillor from Fribourg is nevertheless not yet home and dry with his major initiative. On 24 September, the Swiss people and the cantons will decide on the increase to VAT which is linked to the bill. If voters reject the additional funding for AHV, the entire reform of the first and second pillars will fail.

Historic stress test for AHV

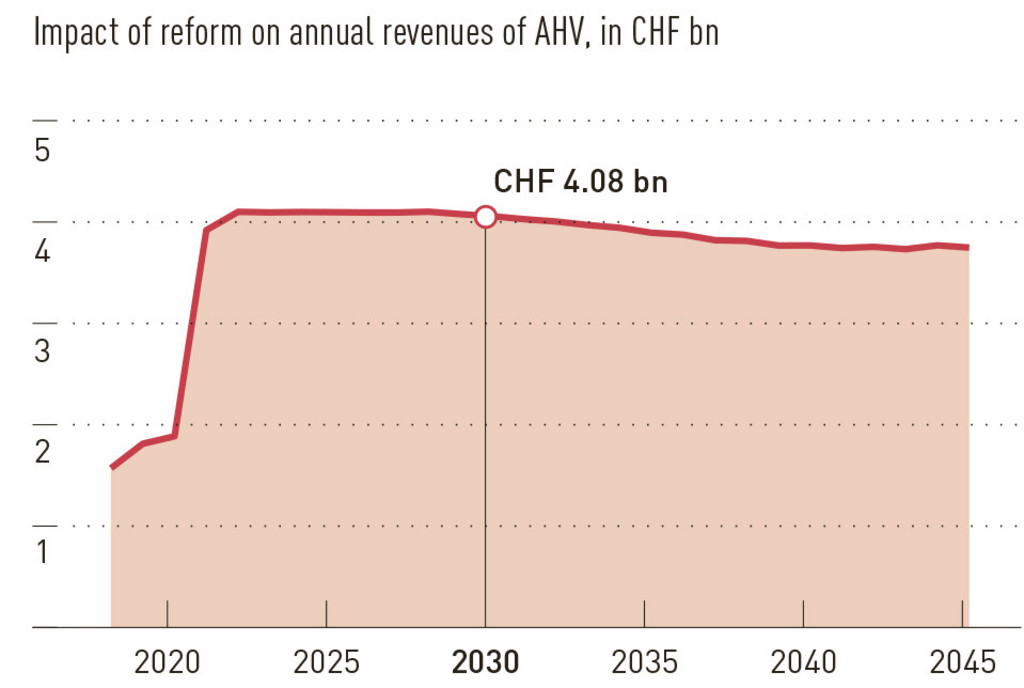

There is agreement on the need to renew the social institutions right across the political spectrum. The last AHV reform to successfully pass a referendum was that of the SP Federal Councillor Ruth Dreifuss in 1995. The number of pensioners and life expectancy have since increased further. AHV – Switzerland’s main social institution – is facing an historic stress test. The baby-boomer generation will enter retirement over the next 15 years. Around 6.5 people in employment financed one person of pension age when AHV was introduced in 1948, 3.4 working people cover the costs for one pensioner today and in 20 years from now the ratio will stand at 2 to 1. From the beginning of the next decade, AHV will have deficits running into billions each year and the AHV capital will be used up by 2030 unless the insurance scheme receives additional funding or relief through cost-cutting measures.

The proposed reform provides for both. The pension age for women is to be brought into line with that for men and raised to 65 years of age. AHV will also obtain additional annual income of around CHF 2 billion. In the second pillar, pension benefits will be brought into line with increased life expectancy. The conversion rate, which determines the pension amount, will be lowered. This will result in a 12 % reduction in pensions. However, Parliament has learned from the failed referendum on the conversion rate and agreed compensatory measures. But it is this issue of pension compensation that lies right at the heart of the dispute between the centre-left and the centre-right. The National Council majority – made up of the Free Democratic Party (FDP), Green Liberals (GLP) and SVP – wanted to completely make up for the pension reduction through higher savings contributions in the second pillar. However, the centre-left alliance ultimately triumphed. Under their proposal, future pensioners will receive an additional CHF 70 a month in AHV benefits and retired married couples will get a higher maximum pension.

The disadvantage of such a narrow majority

The wafer-thin parliamentary majority is not a good starting point for securing majority support from the electorate for pension reform. The rather unusual alliance of CVP, SP and the trade unions argues that it is a well-balanced bill which maintains the level of pensions while also putting the social institutions on a solid financial footing until 2030. The FDP, SVP, employer and trade associations, on the other hand, believe the increase in the AHV pension is irresponsible in view of the demographic trend. Future generations would have to pick up the bill. The pension increase wouldmore than eat up the savings from increasing the pension age for women. Opponents are also seeking to exploit the fact that existing pension recipients will come away empty-handed from the increase in AHV pensions. They are trying to score points with the catchphrase “two-class society” made up of the better-off future pensioners and the existing ones.

The left is not completely united over the pension reform either. In particular, the trade unions in French-speaking Switzerland reject the increase in the pension age for women. Some female trade unionists are even calling for a significant increase in pensions for women to make up for the gender pay gap on the labour market. However, the leaders of the SP and the Swiss Federation of Trade Unions are seeking to persuade their support base with the argument that the left has managed to wangle a substantial increase in AHV pensions out of the conservatives for the first time in decades.

Chance of reform remains

There is still a chance of securing approval for the reform at the ballot box. It is doubtful whether the FDP, SVP and business associations can form a strong enough opposition. Some FDP MPs in particular will find it hard to encourage the public to vote no. After all, if the reform should fail, it will be difficult to pass the required measures quickly enough to prevent AHV running up a deficit in view of the entrenched positions. The Swiss Trade Association cannot unanimously come out against the proposal because individual members, such as the Gastrosuisse and Hotelleriesuisse sector associations, support the reform. Some employer associations in French-speaking Switzerland also back the reform. It remains to be seen whether the SVP will go all out to thwart the bill as their supporters are often closer to left-wing positions on old-age pension than the hardline restructuring approach of their own party. The SVP party base played a significant role in ensuring that the reduction of the conversion rate failed at referendum in 2010.

The SVP is nevertheless now fighting alongside the FDP in Parliament for a bill that not only increases the pension age for women but also paves the way for setting the retirement age at 67. If the bill fails, the FDP and SVP will attempt to restructure the social institutions step-by-step. They will focus on increasing the pension age for women and a small rise in VAT. The conversion rate would then be reduced in a second bill with compensatory measures in the second pillar. As a third step, the right-wing parties will try to push through an increase in the retirement age to 67.

Concocted in a small group

On the other hand, a yes from the Swiss people and cantons would provide confirmation for the architects of the reform that the majority support of the Swiss people can only be secured if social equilibrium is provided for as well as austerity measures. An AHV increase of CHF 70 and the raising of the ceiling for the pension of married couples constitute such equilibrium. This plan was concocted on the Council of States’ Social Affairs Committee made up of Urs Schwaller (CVP, FR), Christine Egerszegi (FDP, AG), Verena Diener (GLP, ZH) and Paul Rechsteiner (SP, SG). This centre-left alliance got the compromise pension proposal through the Council of States in September 2015, shortly before the parliamentary elections. But three of its four architects did not stand again at the elections in October 2015. Only trade union leader Rechsteiner remained in office. This has made the debate in the National Council more difficult.

The fact that four veterans from the smaller chamber had concocted a pension reform between them which they saw as the final compromise was regarded by the larger chamber as a provocative step. The National Council, which shifted to the right at the election in October 2015, did not want to be presented with a done deal on one of the most significant reforms of recent decades.

Markus Brotschi is the federal political affairs editor for the “Tages-Anzeiger” and “Der Bund”

The key changes to old-age pension 2020

- The pension age for women will increase by three months each year from 2018. From 2021, women will not receive a full pension until the age of 65.

- The pension age will be made flexible. The reference age is 65, from which entitlement exists to a full pension from the first and second pillars. However, there is now the option of working beyond the official retirement age of 65 and increasing the pension to the maximum level with the AHV contributions. AHV contribution gaps can now also be made up, which was not previously possible.

- AHV will receive additional funding: From 2018, the revenues from 0.3 percentage points of VAT will go to the AHV fund. An increase in VAT is not required for this as it concerns tax revenues that previously went to invalidity insurance. VAT will then be increased by 0.3 percentage points in 2021 to further shore up AHV.

- People retiring from 2019 will receive extra AHV of CHF 70. The rise will increase the maximum AHV pension from CHF 2,350 today to CHF 2,420. Married couples can expect an increase of up to CHF 226 a month. This is due to the fact that the maximum pension for married couples will be 155 % of the maximum single pension in future. The pension increases should make up for some of the losses in the second pillar.

- The increase in AHV pensions will be financed with an additional 0.3 percentage of wages, half of which will be contributed by employers and half by employees. However, this funding will only be sufficient until around 2030.

- From 2019, the conversion rate will gradually be reduced from 6.8 % to 6 % for the mandatory occupational pension. This means that for CHF 100,000 of retirement assets, CHF 6,000 in annual pension will now be paid out instead of CHF 6,800 previously. However, the losses will partially be offset by a reduction in the coordination deduction. Pension scheme contributions will have to be paid on a higher proportion of salary in future. This means more capital will be saved.

- A 20-year transitional generation will also be given a pension guarantee. Everyone aged 45 and over when the reform enters into force will receive a pension at the conversion rate of 6.8 % in the mandatory part of the occupational pension. However, 85 % of those insured have a pension fund with non-mandatory benefits provision which is why only a minority will effectively benefit from the pension guarantee.

What does the reform mean for the Swiss Abroad?

The Swiss Abroad with AHV insurance will also benefit from the CHF 70 increase in pensions and the higher benefits for married couples. There are also some changes to AHV in terms of provisions concerning contributions which will have an impact on the Swiss Abroad:

- Children who accompany their parents abroad and are aged under five or who are born abroad can no longer obtain voluntary insurance. However, they can now include the prior insurance period of a parent when they become liable for contributions themselves (when they reach the age of 17 if in gainful employment or when they reach the age of 20 if they are not in gainful employment). Children do not suffer any disadvantages from the change up to this point as they have entitlement to invalidity insurance rehabilitation measures based on the Federal Act on Invalidity Insurance.

- Family members (not in gainful employment) of people who work for federal government abroad and enjoy special rights and immunities (e.g. diplomats) are now automatically insured.

- Employees working abroad for an employer with its head office in Switzerland now only need a prior insurance period of three years instead of five previously.

- People not in gainful employment who accompany their spouses, who have AHV insurance, abroad must now continue the insurance and also provide evidence of three years of prior insurance (previously they were admitted to the insurance scheme without a prior insurance period). Spouses will now be treated equally, and people without a sufficient association with Switzerland will no longer be able to obtain AHV insurance.

- Employees working for private aid organisations heavily subsidised by federal government in a non-contracting state now no longer have mandatory insurance. They can continue the insurance by providing evidence of a three-year prior insurance period.

AHV insurance generally remains voluntary for the Swiss Abroad. If they want AHV insurance, they must have had AHV insurance for at least five consecutive years at the time when they left Switzerland. In cases where insurance is being continued – such as employment with a Swiss employer abroad – a reduced prior insurance period of three years now applies. Contributions do not need to have been made during the prior insurance period. Insured status is nevertheless required. People living in an EU or EFTA state cannot be insured under AHV.

There are no specific changes for the Swiss Abroad under the second pillar. The same changes apply to them as to everyone residing in Switzerland with occupational pension provision. The principle that only income already insured under AHV can be insured in the second pillar continues to apply. The Swiss Abroad can only continue insurance under the second pillar if they also remain insured under AHV or have voluntary AHV insurance. If this is the case, they can either continue the insurance policy with the previous pension fund – providing it offers this – or continue insurance with the occupational pension contingency fund. It is not possible to join a second-pillar scheme abroad after a period of time if such insurance did not previously exist in Switzerland.

Comments

Comments :

Ich empfine dies empoerend und beschaehmend, der groessere Teil der im Ausland wohnenden AHV Bezueger waren ehemalige Gastarbeiter und haben die AHV verdient mit ihrer Arbeitsleistung haben sie nicht auch zuletzt auch ihren Teil zum Wohlstand fuer die Schweiz beigetragen und auch Steuern bezahlt.

Und Schweizer die Auswandern aus welchen Gruenden immer haben das Anrecht zu leben wo es ihnen passt, viele dieser wuerden wenn sie in die Schweiz zurueck kehren sogar noch Ergaenzungsleistungen beantragen muessen da man ja in der lieben Schweiz heutzutage nur mit der AHV allein nicht existieren kann.

Meine Antwort, gebt der FDP und SVP an den naechsten Abstimmungen die Quittung fuer ihre Haltung.

Had I not put my money into a Savings account long time ago,

my situation would have turned out much different and perhaps not to my advantage. I give thanks to the Most High and Merciful for keeping an eye on me for 77 plus years.

A bon entendeur

Zur Information: Ich bin Mitglied des ASIP-Redaktionsteams auf dringendereform.ch

Travail = revenu devient de plus en plus fausse. Le temps est bientôt là où cela sera complétement faux. Si l'on persiste dans cette direction, on va souffrir.

Un humain faisant un certain travail contribue à la communauté par l'impôt. (tendance à la baisse)

Une machine, elle ne le fait pas, vu qu'elle ne paie pas d'impôt.

(Tendance à la hausse)

C'est vrai que son AVS coûte moins cher pour une machine ou une usine. (quoique pas toujours, demandez donc le prix du démantèlement d'une usine nucléaire à un vert)

Alors un grand MERCI de penser aux jeunes générations d'ABORD.

merci et cordialement