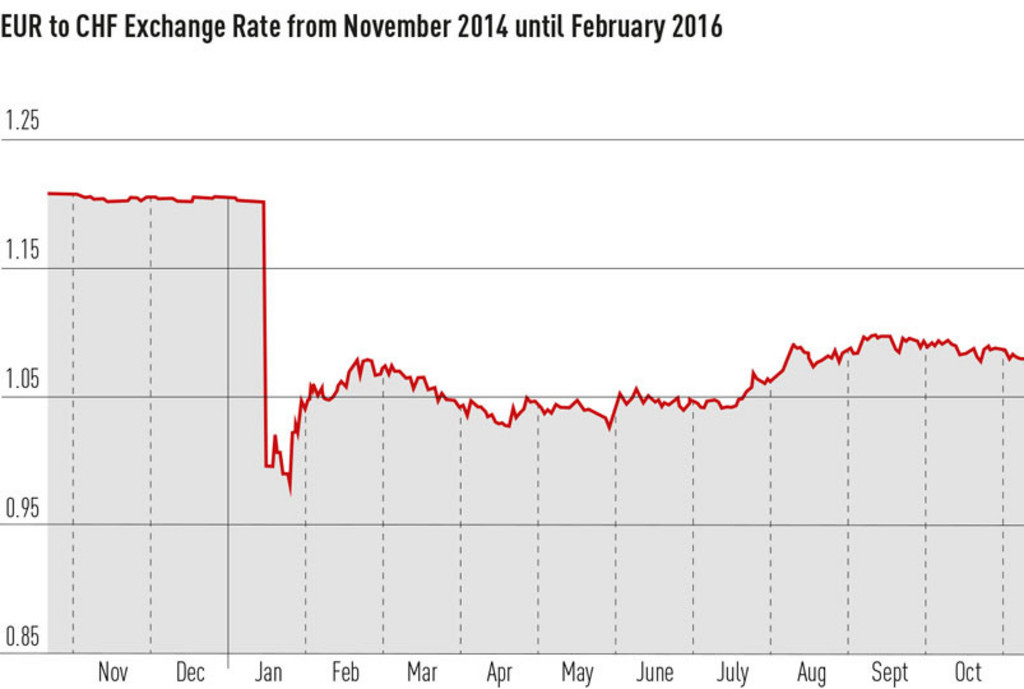

It was a difficult moment for Thomas Jordan when he appeared before the media on Thursday, 15 January 2015. The chairman of the Swiss National Bank (SNB) was perceptibly tense because his decision, which had been announced several hours earlier at 10.30 a.m., triggered a tremor on the foreign exchange market. The euro-Swiss franc minimum rate of 1.20 no longer applied.

The SNB’s three-member Governing Board was now relying on negative interest instead of the minimum rate: “To ensure the removal of the minimum rate does not result in undue tightening of the monetary framework conditions, the National Bank is cutting the interest rate significantly,” said Jordan at the time. The introduction of penalty interest of minus 0.75 % on bank balances aimed to deter investors from depositing their money in francs, thus ensuring the value of the franc did not rise too much. This succeeded to an extent. During the major crises of recent months, less money flowed into Switzerland and there was lower appreciation pressure than in previous years, even during situations like the Greek debt crisis in the summer.

Since 15 January 2015, Switzerland has been the only small country with a very open economy that refrains from any linking to larger currency zones – with consequences that will continue to be felt, even if the initial appreciation of the franc against the euro by almost 20 % has since halved. While the Swiss economy has not fallen into recession, the “Swiss franc shock” has had a far-reaching impact on industry, trade and tourism.

Great uncertainty

There is still great uncertainty over the future development of the exchange rate: “The monetary policy system has been out of kilter since the 2008 financial crisis as Switzerland has since taken the rap for any anxiety on the financial markets through its currency,” remarks Martin Neff, chief economist at the Raiffeisen Group. He believes we have been in an extraordinary phase of appreciation since 2008 which bears comparison with the difficult period after 1973. Around 10 % of jobs were lost in Switzerland at that time. This view is also shared by the economist Bruno Müller-Schnyder who has attempted to determine the cost of abandoning the minimum rate in a study. This can be observed in various areas:

The economy: The de-coupling from the euro paralysed the previously buoyant economy. Following a 1.9 % growth rate in 2014, the Swiss economy only grew by a meagre 0.7 % in 2015, according to the latest estimates. By contrast, the economy of the EU countries expanded by 1.8 %. At +1.1 % growth this year, according to the KOF economic research unit at the Federal Institute of Technology (ETH), Switzerland will again lag well behind Germany (+1.8 %).

Labour market: If the economy falters, unemployment rises after a certain period of time. The unemployment rate climbed to 3.8 % in January 2016 – a year earlier it stood at 3.5 %. In total 163,000 people are now registered as unemployed – 8.4 % more than in January 2015. That is the highest level since April 2010. Companies which primarily manufacture in Switzerland and only benefit to a limited extent from cheaper purchasing prices abroad are being hit. These include traditional sectors of industry, such as metalworking, electrical engineering, watchmaking, mechanical engineering and automotive manufacturing. “We anticipate further redundancies in industry,” Neff indicates. Valentin Vogt, chairman of the employers’ federation, anticipates that the rise in the value of the franc will have cost around 20,000 jobs by mid-2016. Unemployment figures in Europe are currently falling. Germany has reported its lowest unemployment since 1991. In the German federal states of Baden-Württemberg and Bavaria, which border Switzerland, the rate fell to 3.7 % and 3.4 % respectively in December.

Structural change: The growth in GDP hides the fact that Swiss industry is in recession and is shrinking. Around 45,000 jobs have been lost here since 2008. The companies oriented towards foreign markets have attempted to retain their market shares there by relinquishing their profit margin. But now they are increasingly focussing on procurement abroad, relocation, cost-saving measures and headcount reduction. They lack the planning certainty required for investing after the end of the minimum rate. “The export-oriented companies have not yet come to terms with the appreciation of the Swiss franc,” says Daniel Küng, head of Switzerland Global Enterprise, the organisation responsible for promoting foreign trade. “Last summer, many companies simply didn’t know how to deal with the currency appreciation or how to retain revenues and profit margin.” The situation has since been alleviated somewhat thanks to a slightly weaker Swiss franc. “Companies have increased productivity, extended working hours, purchased abroad more and relocated or halted processes,” says Küng, outlining the results of a business survey. “De-industrialisation has begun in Switzerland,” confirms Franz Jaeger, an experienced economic policy-maker and emeritus professor of economics at the University of St. Gallen. The Swiss economy is undergoing far-reaching structural change, “but this is based on distorted exchange rates that are not justified in real economic terms”, criticises Bernd Schips, former head of KOF.

Shopping tourism: For most people the most immediate effect of the stronger Swiss franc is that they can now go on holiday abroad less expensively and can shop more affordably on the other side of the Swiss border. Having overvalued Swiss francs in their pocket has encouraged the Swiss to travel abroad much more often: last year, a total of around 12 to 13 billion Swiss francs was spent abroad. The Swiss retail sector is losing out on billions of francs in revenues due to the distorted currency rate. Many shops in the city centres of Basel and Zurich have even closed down. Conversely, Swiss tourism has suffered a significant decline in visitors from Europe. The number of overnight stays by Europeans fell by 4.3 % and the decrease was even greater in the mountain regions. The growing number of Chinese tourists can only partly make up for this shortfall because spending by Asians on accommodation and food is only a fraction of that by European visitors.

Deflation: The currency appreciation has led to a huge fall in import prices. This drove consumer prices down to minus 1.3 % in December compared to the previous year. The National Bank should in fact ensure monetary stability, but prices have been falling for several years.

Savings: The negative interest and extremely low interest rate levels are weighing down savers and pension funds, which are barely achieving any yield on their capital investments. The pension fund association Asip estimates a direct shortfall of around 400 million Swiss francs as an express result of negative interest. However, the base rate would probably have been lowered into the negative range even if the minimum exchange rate had been continued.

The costs of abandoning the minimum rate are placing such great strain on the economy because the Swiss franc strengthened abruptly. A long-term view over a 40-year period shows that the Swiss franc’s external value compared to 27 countries – adjusted for inflation – has only risen by 0.4 % a year on average. The economy can, of course, cope with periods of continuous currency appreciation.

The sudden drop in the euro after the abandonment of the minimum rate from 1.20 to around 1.02 Swiss francs led the National Bank – in addition to introducing negative interest – to intervene in the foreign exchange market after January 2015. “The value of the franc has risen so strongly that it cannot continue without a damaging impact on the export industry and tourism,” remarked Serge Gaillard, Director of the Federal Finance Administration. In summer 2015, the SNB stabilised the rate at around 1.04 francs when the Greek crisis flared up again by means of currency purchases of 18 billion Swiss francs. A franc rate close to parity with the euro was deemed too damaging to the Swiss economy. In January, the SNB was able to maintain the rate at around 1.10 Swiss francs.

Criticism of the National Bank

The traces of the currency purchases are apparent in the SNB’s balance sheet. From January 2015 to January 2016, the foreign exchange reserves rose again – by 77 billion Swiss francs – and now stand at 575 billion. Around half of this increase is attributable to SNB interventions, while the remainder is due to slightly stronger foreign currencies and earnings from foreign currency investments.

Criticism of the National Bank’s course of action has grown. Since January 2015, the monetary authority has relentlessly reiterated that there was no alternative to de-coupling from the euro. However, such rhetoric is not shared by all economists. Professor of economics Jaeger firmly believes that more vigorous intervention is needed. “The SNB must weaken the franc,” he stated last November. The economist Bruno Müller in turn recommends – as do a number of professors – a new minimum rate against a currency basket made up of two units euro and one unit dollar.

However, there are currently strong indications that the National Bank is not seeking a radical change of direction but is instead working with an implicit minimum rate which is not being declared publicly. With the current rate at around 1.10 Swiss francs to the euro, it has already been able to significantly improve the situation for large sections of the Swiss economy.

Daniel Hug is Chief Business Editor at the “NZZ am Sonntag”

![[Translate to English:]](/fileadmin/_processed_/3/7/csm_max-spring-3-cartoons-de_3c29839370.png)

Comments

Comments :

Davon betroffen bin ich in zweierlei Hinsicht ; zum Einten der Wert meiner Aktien , die in dieser Rezession merklich nachgegeben haben ; und dann der festere CHF Wechselkurs , welche mir eine hoehere Rente in Thai Baht bescherrt .-

Allen Respekt Ihnen gegenüber und viel Glück weiterhin.

Das vorhersehbare desaströse Eurodebakel der Nationalbank.

Der Umstand, dass jenseits der schweizer Grenze die Welt nicht aufhört. Ebenso, dass sich der CFR infolge seiner Eigenschaft als geradezu ideales Spekulatiionsobjekt an-

bietet, verbunden mit dem vorhandenen internationalen Ri-

sikopotenzial, lässt doch nur einen einzigen Schluss zu.

Wechsel der Währung. Denn zur Zeit sind wir noch in der Lage zu verhandeln. Aufgrund der obwaltenden Umständen ist es doch abzusehen, dass der CFR kurzfristig durch die Decke gehen wird. (Dasselbe, ein wenig anders, gilt auch für einen Eintritt in die EU)

Es ist mir bewusst, dass aufgrund meiner nüchternen Ana-

lyse ein wahrer Tsunami der Empörung aufkommen wird. Ich kann damit leben, Denn die Erfahrung meiner letzten 50(fünzig)Jahren beweisen mir immer wieder folgendes. Je lauter das Wehgeschrei und je dicker die Krokodilstränen,

desto näher bin ich bei der WAHRHEIT.

Die Nationalbank treibt da ein Spiel das Schweizervermögen vernichtet und zwar der Schweizer Bevölkerung seines.

Wenn die Wirtschaft endlich mal mehr für die Produktion tun würde als nur in Gebäude und aufgeblasene Verwaltung inkl. den Manager die horrende Bonus abstauben. Dann würde das ganze anders Ausschauen aber eben der kleine kann sehen wo er bleibt. Das gleiche gilt für die Bundesverwaltung und Parlament mit überbezahlten Bundesrat. Da wird nichts grossartiges gemacht sondern nur kassiert.

Andersherum sind die hohen Kontogebühren für Auslandschweizer. 6.-CHFR pro Monat sind für die Bank, bei 2000.-CHFR Rente = 3.6% Bruttorendite. Dazu kommt für die Konvertierung in EURO nochmals ca. 5% für die Bank. Also eine Belastung für den Rentner von ca. 8,6% auf seine Einkünfte. Also wiederum ein gutes Geschäftsmodell für die Banken.